Payment on acounts

I recently released a mini-series of articles with a load of great business start-up advice (also available to download as a PDF) in which I talk about how the government is really going the extra mile for SMEs at the moment, helping them out in a load of different ways -really trying to encourage entrepreneurship within the United Kingdom. This was something I believed until I got my tax bill.

The deadline for your self-assessment tax return is fast approaching and the government kindly sends you an invoice for your last tax return, mine arrived just before Christmas and to my surprise it was 50% more than I submitted. Seeing as I was off to Cornwall I decided I would deal with it on my return.

I've never had an issue with paying tax, in fact I've always been proud of the fact that I've needed to pay tax, my logic is simple: if I need to pay tax, it means I'm earning! The more tax I pay, the more I've earned. See my logic?

In the past, through claiming back expenses etc my tax bills have always been relatively small and although I seem to recall something called “Payment on account”, but it was IIRC an optional payment so next year the amount you have to pay is smaller. This is a good idea. As a small business owner I do put money aside for my tax bill but that’s always been 25% of each invoice. So what’s my issue?

To me, payment on account seems like a half-arsed attempt by the government to help self-employed people out, while getting a couple more quid in the process, the issue however is I feel they’ve focused more on taking more money than helping out the self-employed people. The idea is simple: You submit your tax bill for the previous tax year, they take an additional payment (payment on account) which will go towards the next tax year, this payment is estimated on their data for you -in this case your tax bill. The first payment is due with your current tax bill, the second in July of the current tax year. Thus splitting the next year’s tax bill into two more manageable payments. -Bollocks does it. Please excuse my French but this is not at all thought out and this is why:

I would consider myself to be one of the more sensible self-employed people when it comes to saving for tax, admittedly the first couple of years I was in business I paid the tax bill with a project we had on at the time but now I do put money aside for it with every invoice (now 50% of every invoice inc VAT goes aside). So come tax return time I have a nice chunk of cash to pay for my tax bill (always more than it needs to be because of expenses etc). I then follow the governments recommendation and fill out my self-assessment tax return online in plenty of time -a word of warning, I live with a chartered accountant who helps me out with this, it’s not something I just do on my own ;). In January I have the invoice for the bill and I pay it out of my savings, anything left I can use as I wish. All good so far! As far as the government is concerned I have followed what they’re recommending and that should be it. Payment on account however throws this into turmoil. What the government IMHO neglects to tell you is that you’re going to have to pay 50% more than you’re expecting in the first year you go over their threshold.

What I don’t like about that is they’re encouraging a lot of self-employed people to complete their own return online (best to do this with an accountant really) and save for their bill but by not telling you about this additional payment they can in theory put someone out of business over night -and there’s nothing you can do about it. Take the average self-employed business owner with a turnover of £50,000. Assuming no expenses you should expect to walk away with around £38,300 (using rough maths). Cool, so you’re good and put £11,700 into savings in preparation and use the rest to pay the bills, buy a holiday, a car etc.

You think all’s dandy until at the end of the year you get a tax bill for £17,550 with a further payment of £5,850 being required in July. That leaves you with £26,600 remaining rather than the initial £38,300 you were expecting. Why? That’s simple -payment on account, the tax office say "Well, you earned £50,000 this year, so you’ll do that next year so we’ll take that money from you now, that way next year you’ll already have some money on account -helping you out. Don’t worry though, if your tax bill for next year is lower, we’ll refund the money." -there are so many issues to this statement but I’ll come back to those.

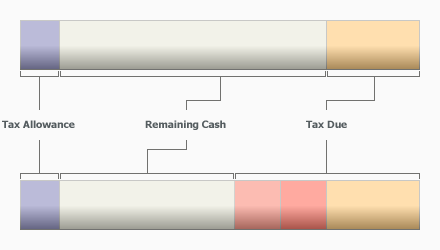

I've made a graph demonstrating the two differences. The light red segment is the amount you will need to pay in the July following your January tax payment, the dark red section must be paid in addition to your main tax bill.

Take my industry -the IT industry. It’s not unknown (or an infrequent occurrence) to have a large project (i.e. £100,000) which you can complete within a financial year. If you're already working in the sector and this £100,000 contract is your reason for going it alone this could be a serious issue for you. Ignoring how you take this money, by the end of a single fiscal year you take £100,000:

- Turnover:£100,000

- Tax Allowance:£5,000

- Taxable Income:£95,000

- Tax at 22%:£7,700

- Tax at 40%:£24,000

- Expected Tax Bill:£31,700

- Expected to you:£68,300

In the event you’ve taken £100,000 for a project you’re likely to spend a fair amount of that on things like credit cards, niceties after having gone without for a while etc, so you spend a fair whack, perhaps put a chunk on your mortgage, buy a house or invest a fair chunk. Say you get the payment a couple of months before the tax year ends so you take the time off and relax a little, basically using a fair amount of the money, but you’re ok as you’ve put £32,000 into savings in preparation for your tax bill. When it comes to filing time however you’re told that you owe them an additional £15,850 with your current tax bill followed by another payment of £15,850 in July. Starting to see where my issue lies?

If you didn’t spend anymore of that £68,300 than you absolutely had to and some how had the additional £31,700 available you’re fine, but what if you decided to treat someone special, or invest the money where it’s not readily accessible, what can you do? I called the tax office to talk it through with them as I didn’t want to pay this payment on account as it would mean that things would be a little tight until the end of a current system development. The representative had absolutely no concern or understanding for my situation, when I asked her if I could spread the payments a little I was told that interest would be charged on the money if I didn’t pay it and a fine would be incurred. Furthermore she told me that this payment on account was ok because it was tax on money we had already earned (the payment on account is in theory for the current fiscal year), I did think about pointing out that a business’ earnings are not the same as a worker’s salary as they are frequently sporadic and go through highs and lows -in the case of The Site Doctor, the majority of our year’s income comes in during the final fiscal quarter.

There were a couple of things I didn’t like about the representatives statement/government’s perceived understanding of the situation:

- Great they are trying to help you out with your business -hopefully making the next tax year’s tax bill a smaller payment (or not at all if you think about the logic) but how does making it a forced payment without making it very well known about help?

- It assumes that your business’ monthly turnover is the same as an employee in that your entire year’s earnings are the same (or similar) each month with no seasonal fluctuations. I know there are some more established businesses which do have a regular income but The Site Doctor certainly doesn’t. As already mentioned, The Site Doctor has the majority of the year’s earnings paid in the final fiscal quarter -after you have to pay your tax bill!

- They say they’ll refund the money if your next bill is lower than the last so it’s ok. But taking the example of the £50,000 turnover above, that’s a years worth of interest on £11,700 you’ve just lost potential interest of £936 or £2,536 in the example of our £100,000 contract. Can you afford to loose out on that?

- This can in theory put someone out of business, as it happened, I had to pay this bill mid contract when normally I wouldn’t have had any money for a fair while, to make things worse Stacey was having a short sabbatical. Luckily we had the money in savings but if we didn’t we would have without a doubt found it hard to pay.

The solution?

I don’t like bitching and moaning about things without having some form of solution and I can understand that the government wants to get this cash into the bank and after the first year or two it makes things better for them but for goodness sake make the payment optional, perhaps offer a monthly payment option without penalties or at least inform people about this so they can make provisions for it. Had I not found this out before this tax year I would be in serious trouble. Of course, having a tax specialist do your books should have highlighted this for you -and it goes to show that just because they’re an accountant, if they’re not a specialist they may not know about something that can break the bank (I’ve got no blame for Stacey before you wonder!).

Note: These figures are derived from my own experience so please take professional advice on the matter as for all I know, there may be a sliding scale (I would hope there is) otherwise the government is killing businesses left right and centre. I’d be interested to know if anyone else knew of/has experienced this issue.

Liked this post? Got a suggestion? Leave a comment